10 Things To Check Before You Get Your Currency Exchange

Table of contents

It is said that once a year, you should go somewhere you have never been to before. The idea of exploring a new destination, meeting new people, exploring various delicious cuisines sounds so much fun. Yes, the idea of exploring the unknown is the fun way to visit a new country. But then comes to most difficult and annoying part. Doesn’t matter how experienced a traveller is, when it comes to understanding the maths of currency exchange procedures, it brings a dash of sweat on the foreheads of the savviest and expert travellers.

The process of exchanging your any international currency whether it is Euro, Baht, or Dongs is very complicated. Despite a number of easy methods available, it often confuses the hell out of us.

Are you traveling aboard or planning a foreign trip in the near future?Then here are a few quick tips on how to exchange your currency in a foreign land. By following these foreign exchange tips, you will be able to make the best out of your trip without spending too much time calculating local currency rates.

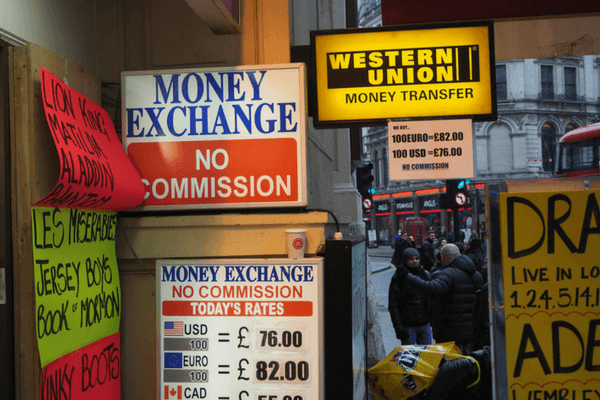

1. Always Avoid No Fee Exchange Offices

Avoid No Fee Exchange Offices

Every tourist spot has a couple of exchange offices which don’t charge any extra fee on currency conversion. Well, you must avoid these places as the currency exchange rate is usually the lowest here. You’ll end up getting way lesser amount compared to the places which have a fee.

Better you get your currency converted at a place where they ask you to pay some transaction charge but will offer you a nice return that is valuable for your journey.

2. Research the exchange rate on a regular basis

Research The Exchange Rates

Gone are the days when one had to run from one place to another confirming the currency exchange value while traveling to a new country. Today, with several apps and websites it is easier to get a track of latest currency value.

Websites like www.xe.com are pre-programmed to save you from time-consuming manual calculations. These sites and apps are also updated in the real time. Researching the exchange rate from these websites gives you the perfect value running on a particular day. You can avoid getting cheated using this method.

3. Understand the currency exchange terminology

The worldwide currency exchange system comes with its own set of jargons and terms. Before you exchange your currency, you need to spend some time getting an understanding of the terminology. The local exchange offices often try to confuse you by throwing these words around. Remembering some of the common terms is the best way to understand how this system works.

Here are some of the important terms that you should get a hold of :

- Exchange Rate: The amount you get in the terms of local currency when you exchange your cash. For example, when an Indian tourist visits Vietnam, the local currency is Dong. So the unit of Dongs that you receive after exchanging INR 100 is the local exchange rate of Vietnam.

- Buy Rate: There is a huge chance that you won’t be spending your entire amount by the time your trip ends. Well, good news for you, you can sell the leftover currency in that country and get back your home country’s cash. The amount that you’ll get after selling the local currency is known as buy rate.

- Bank to Bank rate: Also known as the bank rate, this is the wholesale exchange rate that the banks use among themselves. Usually this rate is how you get your cash withdrawals done at foreign ATMs.

4. Do a proper research on visiting country’s currency

Research About The Country’s Currency You’re Visiting

The major international currencies are very straightforward and exchange process is simple. You can easily spend Yen, Dollar and Pound internationally anywhere and get a proper currency exchange value in every country. But then some of the countries have really weird and unusual exchange rules.

Cuba has a separate currency for the tourists and you cannot exchange Moroccan currency outside the country. Cambodia, Taiwan and Vietnam use US Dollars are their secondary currency. It is important to understand the rules of currency exchange while visiting a new country.

5. Avoid exchanging at the airport

Currency Exchange Booth At The Airport

The foreign exchange offices at airports have the highest conversion fee and rates. They charge you with a margin of 8% to 12% of the cash you pay them. It is better to get some foreign cash in advance before landing there and make the rest of the exchange after a day or two of research in the market.

6. Avoid transacting directly through credit and debit cards

Avoid Transacting Through Your Cards

Credit and debit cards charge high transaction fee when you make a payment in a new country. A lot of banks also block your credit card on the behalf of suspicion. You will actually end up paying more in the transaction fee than you would ever pay during your entire trip.

The best way to avoid this is by not using your cards at all. Also, you should inform your bank about your trip so that they don’t block your cards on mere suspicions and put you in trouble.

Also Read: Things To Remember When Withdrawing From An ATM Abroad With Local Bank

7. Forex cards avoid unnecessary transaction fee

Use Forex Card And Avoid Transaction Fee

Always remember to carry Forex cards when you are traveling aboard. It comes handy in a lot of ways. A cash card gives you a hundred per cent return for all your money, it automatically converts the amount present in the card to that of local currency.

A Forex card prevents overspending and can be recharged at any moment of time. With cash card you don’t have to carry unnecessary money in your pocket and this way you can avoid the fear of losing them.

Also Read: Benefits Of Having A Forex Card

8. Avoid the universal currency exchange practices

As said earlier, Dollar is one of the most popular currencies all over the world. Many of the South Asian countries use Dollar as a second currency system. When you are shopping or making a purchase in a foreign country, the locals often give you an option of paying in terms of dollar. The argument given in the favour of this practice is that it makes the tracking of expenses easier.

You should always say no to such offers and insist making the payment in the local currency. This way you can evade a widespread method of getting cheated as these shops charge unnecessary conversion fee in the name of dollar or what they call, a dynamic currency exchange.

9. Exchange your currency in advance

Exchange Your Currency In Advance

You don’t need to exchange your currency exactly when you land at the airport. You can start looking around for currency conversion a month or two before your trip starts. All you need to spot a day when you can get maximum money while exchanging the local currency from a foreign exchange office.

10. Always compare between multiple shops

The currency exchange rate is ever fluctuating. It not only goes up and down on a daily basis but the rate goes through serious variation from one trader to another. The currency exchange rates around the airport and prime market areas are comparatively higher than the ones around less popular touristy areas.

All you need is to spend some time researching the most valuable and beneficial trader who’ll be the most profitable for your trip.

With these easy hacks you can save a lot of money on local exchange rates and avoid getting cheated during the trip. The money saved on a trip will benefit you in the long run. Using these easy foreign exchange tips you can make your trip an affair to remember.

Table of contents

Trending blogs for you

Top Visa on Arrival Countries for Indian Passport Holders in 2025 – Part 1

Thomas Cook Forex Card vs. HDFC Bank Regalia Forex Card: The Ultimate Showdown

Thomas Cook Forex Card vs. ICICI Bank Travel Card: Which is the Smart Choice?

Recommended Articles for you

Thomas Cook Forex Card vs Niyo Global Card: A Real Travel Comparison

Reading Time: 6 minutes 0 0 Planning a 2025 international trip and seeking the best forex card for travel to manage your international travel money? Whether you’re exploring budget-friendly destinations like Manali or jetting off to Paris, prepaid travel cards like the Thomas Cook […]

Top Visa on Arrival Countries for Indian Passport Holders in 2025 – Part 1

Reading Time: 8 minutes 1 0 Travelling around the world is an exciting and fulfilling experience, but the process of obtaining a visa can be daunting and time-consuming. Fortunately, many countries offer visas on arrival for Indians, making travel easier and more convenient. In […]

Best Forex Cards in India: Features, Benefits & How to Choose One

Reading Time: 6 minutes 0 0 Planning a 2025 international trip and searching for a secure, cost-effective way to manage your expenses? The best forex cards in India offer a cashless, budget-friendly solution for travelers like you, who enjoy affordable adventures in foreign destinations. […]

Thomas Cook Forex Card vs. HDFC Bank Regalia Forex Card: The Ultimate Showdown

Reading Time: 6 minutes 0 0 Planning an international trip in 2025 and wondering which forex card saves you money while offering convenience? The Thomas Cook Forex Card and HDFC Bank Regalia Forex Plus Card are top contenders for the best forex card for […]

Thomas Cook Forex Card vs. ICICI Bank Travel Card: Which is the Smart Choice?

Reading Time: 5 minutes 0 0 Planning an international adventure or study abroad program and wondering how to manage international spending? Whether you’re a student heading to the USA or a traveler exploring Europe, choosing the best travel card for students is crucial for […]

Currency Comparison: World Currencies VS Indian Currency Exchange Rates

Reading Time: 7 minutes 7 1 In today’s globalised world, currency exchange rates play a crucial role in international trade and finance. Currency exchange rates determine the value of one currency against another, and they fluctuate constantly based on various economic and political factors. […]

Thomas Cook Forex Card vs. Wise: Comparing Fees

Reading Time: 5 minutes 0 0 Planning a 2025 international trip and seeking the most efficient way to manage travel expenses? Whether you’re exploring budget-friendly destinations or global hubs like London, choosing the right tool for international banking is essential for cost-conscious travelers. The […]

Lowest Currencies in the World with Exchange Rates in INR

Reading Time: 8 minutes 0 0 As you plan your travels or delve into the economics of different countries, understanding currency values becomes crucial. The phrase ‘currencies with the lowest exchange rates in the world’ often piques curiosity, both for economic insights and the […]

How to Take a Career Break and Travel the World

Reading Time: 4 minutes 0 0 Have you ever dreamt of taking a career break to travel the world but felt unsure about how to make it happen? The thought of stepping away from a stable job and embracing the unknown might seem daunting, […]

Travelling with an Indian Passport: Forex Tips and Currency Regulations

Reading Time: 5 minutes 0 0 Travelling abroad is an exciting experience, but managing foreign exchange efficiently is crucial to ensure a hassle-free trip. As an Indian passport holder, understanding currency regulations, forex options, and best practices can help you avoid unnecessary complications. Whether […]

Planning a Trip with a US Tourist Visa: Best Tips for Travelers

Reading Time: 4 minutes 0 0 Planning a trip to the United States is an exciting experience, whether you’re visiting New York’s bustling streets, exploring the stunning landscapes of the Grand Canyon, or enjoying the magic of Disneyland. However, managing your finances wisely is […]

Highest Currency in the World in 2025

Reading Time: 7 minutes 14 0 It is a common knowledge that value of currencies around the world change on a regular basis. Some currencies are considered stronger than many others. There are countries where the Highest Currency is not more than 20 while […]

Why Wellness Travel is the Next Big Trend You Should Try

Reading Time: 5 minutes 0 0 In today’s fast-paced world, where work stress, digital fatigue, and lifestyle-related health issues are on the rise, more people are looking for ways to relax and rejuvenate. This has led to the growing popularity of wellness travel—a trend […]

Traveling With a Japanese Visa: Ultimate Guide

Reading Time: 4 minutes 0 0 Planning a trip to Japan? Whether you’re visiting the bustling streets of Tokyo, the serene temples of Kyoto, or the breathtaking landscapes of Hokkaido, managing your finances wisely is key to a smooth and stress-free experience. Understanding the […]

15+ Places to Visit in Ooty – The Queen Of Hill Stations

Reading Time: 9 minutes 0 0 How does this sound to you: bright green soothing slopes, mystical pathways, and clouds that kiss your hair? Ooty is replete with such immense beauty and has enough activities and elements to keep every traveler happy and satisfied.One […]

PAR: Hong Kong Visa Myths Busted

Reading Time: 6 minutes 0 0 Hong Kong, the Special Administrative Region of the People’s Republic of China (PRC), is increasingly becoming one of the most sought-after international holiday destinations for Indian tourists. This has something to do with its vibrant culture, iconic skyline, […]

Choosing the Best Forex Card for Your Travel Needs

Reading Time: 9 minutes 0 0 Travelling abroad can be an exciting adventure, but managing your finances while on a trip can sometimes be challenging. When visiting different countries, paying in local currency is essential to avoid the pitfalls of unfavourable exchange rates and […]

Top Zero Markup Credit Cards for Forex Transactions in India in 2025

Reading Time: 9 minutes 0 0 Traveling internationally often comes with various expenses, and one of the most significant is currency conversion. Traditional methods, such as exchanging cash or using credit/debit cards, usually involve hidden charges, hefty conversion fees, and unfavourable exchange rates. Enter […]

Why You Should Consider Trading Forex: 12 Key Insights

Reading Time: 5 minutes 0 0 Foreign exchange trading, commonly known as forex trading, has grown to become one of the most popular forms of trading worldwide. With a daily trading volume exceeding $7 trillion, it represents the largest and most liquid financial market. […]

Key Differences Between Regular Bank Accounts and Overseas Bank Accounts

Reading Time: 5 minutes 0 0 In a globalized world where people frequently travel, migrate, or conduct business across borders, understanding the distinction between regular bank accounts and overseas bank accounts is crucial. While both serve the primary purpose of storing and managing money, […]

18002099100

18002099100